M&A Procurement Capabilities: Integration

Part 3 – Integration

M&A Procurement Capabilities: Integration. A three-part guide for CEO’s, CFO’s and CPO’s to assess how procurement can make a critical difference to capturing the value in M&A

In Part 2 we discussed pre-planning and due diligence. Here in part 3 we discuss integration.

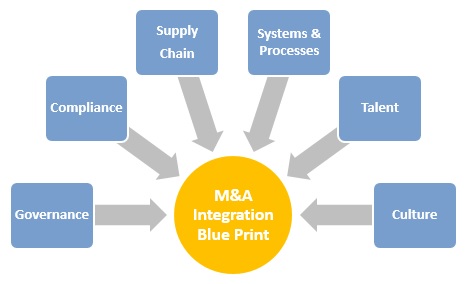

By developing well defined processes beforehand to manage these changes, procurement is best placed to produce a detailed plan covering post merger, (See Integration Framework below) :

1. Procurement Integration blue print

The integration blueprint maps out the new organizations procurement function, the way it will work and how decisions are made. The aim is to achieve a ‘one company focus’, by standardizing procurement work. Four key enablers are essential to achieving this:

- Procurement Governance & Organizational Alignment

- Purchasing Processes and Practices

- HR & People Development

- Systems & Tools

The identification and utilisation of supportive champions from the acquired company will help overcome resistance to change. Utilising these people on selective integration teams helps ensure they are involved in decision making, under the umbrella of governance. The integration teams should be set up to manage the issues described below.

1.1 Governance

It is vital to set up strong governance around integration from the start to ensure effective and efficient decision-making, execution and communication across the organization. Roles may be organized in different ways, but the task described below should have a governance structure that prescribes clear roles and responsibilities, supported from the senior executive team downwards. Typically these may include the following roles which should be considered in establishing governance:

- Integration Champion

- Integration Board

- Executive Sponsor

- Integration Initiative Team

- Strategic Supplier Lead

- Joint Procurement/Supplier Integration Team

1.2 Compliance

It is necessary to ensure compliance with contractual agreements and to ensure key suppliers retain focus on existing goals. Also, making sure optimal call off from beneficial contracts can protect against loss of value from none-compliance.

1.3 Sourcing Synergy

To maximize value capture it is essential to have a clear sourcing strategy from day one. Procurement can then ensure the rapid capture of value from the integration by optimizing phasing of supply side synergies, from quick wins through to longer term synergy potential.

1.4 Supply Chain

a) Supply Base Integration:

Supply base integration is a critical step in integrating the supply chains of both companies. The primary objectives here are to:

- Keep strategic suppliers on track in maintaining already agreed goals

- Achieve integration-related savings, including cutting duplicated supplier capabilities no longer required

- Stabilize non-strategic suppliers

A key objective of the supply base integration process is to categorize suppliers to prioritize the deployment of limited integration resources during the first 12 months.

b) Supply Chain Alignment

In order to establish alignment, the key industry performance metrics need to be assessed. For a typical manufacturing company these might include:

- Cost per shipment: for both inbound and out bound logistics,

- Quality: which can be measured in terms of returns from customers,

- Delivery: in terms of fill rate and perfect order performance from the supplier and to the end customer

If synergies between two merging supply chains exist, then that must reflect on some or all of these metrics.

1.5 Systems and Processes

Here the drive is to go from two organizations to one as quickly as possible and to ensure consistent behaviours from both organisations. For Procurement, the first step is to get your spend cube loaded with the other parties data, so that you can see what they are spending through spend analysis. Spend management systems may either be ‘stand alone’ or integrated with ERP, so integration time depends upon what is found. From an IT perspective, the focus is typically on core ERP implementation which is likely to take longer.

1.6 Talent Retention

Preventing your best talent from jumping ship and protecting IP is a critical objective during M&A. Feelings of uncertainty about the company and their jobs. Feelings of loss for the organisations culture. Survivor guilt and increased stress are all emotions that permeate during M&A.

Often, it is your best talent who decide to take the future into their hands and jump ship. The impact of key talent loss is that it increases the risk of business disruption at a time when business as usual is required to capture the value in M&A.

The loss of IP, relationships, and the cost of finding replacements are all factors to be guarded against by considering such tools as retention bonuses, professional development and focused leadership.

1.7 Culture

In my own experience, it is essential that there is a dominant culture that prevails in an M&A. The objective therefore becomes achieving a full commitment to the ‘new way’, as soon as possible. The ‘deculturation’ of the acquired organisation can be painful and upsetting to those involved in what amounts to a loss of identity. This calls for sensitivity on the part of the acquiring company if undesirable outcomes are to be avoided.

It is well to remember that deals are about people.

Nuff said …