Procurement Savings: Show me the money

Discover the missing link to improved bottom line performance through cost transparency and control.

Procurement Savings: Show me the money – A guide to turn data into intelligence to secure the bottom-line-savings to drive improved financial performance, greater control and reduced risk.

1. Introduction:

Despite all the talk of moving beyond cost savings, the relentless pressure to drive continuous cost reduction continues

CFO’s want sustainable cost reduction. Not one-time improvements, but sustainable year on year savings. However, prior to the recession, many CEOs focused on driving revenue growth as a means of increasing EPS (earnings per share) and often ignored or neglected the development of cost management capabilities.

CFO’s want sustainable cost reduction. Not one-time improvements, but sustainable year on year savings. However, prior to the recession, many CEOs focused on driving revenue growth as a means of increasing EPS (earnings per share) and often ignored or neglected the development of cost management capabilities.

The last recession changed this focus. Procurement organisations everywhere were expected to deliver rapid and significant savings to help their organisations survive. Now, as the upturn continues slowly, CEO’s & CFO’s are keeping the pressure on CPO’s and looking towards procurement to continue to deliver significant cost and value benefits.

For many CPO’s this has brought an increased focus on spend visibility. Spend visibility provides a window on savings and a comprehensive Spend Analysis is the gateway to Strategic Sourcing – a process with proven effectiveness to capture the targeted savings.

2. Beyond Spend Visibility Towards Spend Intelligence

Actionable spend intelligence can secure a competitive advantage

Insufficient visibility into spending remains a problem for many organizations. It results in large scale inefficiencies and lost value. Achieving spend visibility can, therefore, provide significant competitive advantage to those companies that learn how to turn ‘spend data’ into ‘spend intelligence’, especially in highly competitive industries.

Spend intelligence, enables companies to “out-maneuver” their competitors by leveraging supply markets to lower cost and access external sources of innovation that can drive growth.

Unfortunately, many organisations still find the achievement of spend intelligence difficult due to:

- Fragmented data across multiple ERP and accounting systems

- Accounting systems were never designed to support sourcing activities

- Business Warehouse data is typically tied to ERP system with the same accounting based hierarchies that are not appropriate to procurement and sourcing

Procurement needs systems and resources to convert disparate sources of data into practical supply market facing intelligence. Fortunately, there has been a significant advancement in service provider solutions to assist CPO’s attain the desired Spend Intelligence.

2.1 Fact-based decision-making:

Put the data in the hands of those who need it

Spend visibility provides three key stakeholder groups with valuable management information from which to make fact-based decisions:

- Executive Leadership: to drive strategic direction

- Managers & Finance: to spend data in specific areas of interest or monitor payments

- Procurement: who need to locate, drive, and monitor the next set of savings initiatives

For each group the same data must be converted to practical information, for example; executives require broad-based information while procurement needs greater detail to drive specific category sourcing decisions.

2.2 Spend Analysis

The foundation for spend visibility, savings, compliance, and control

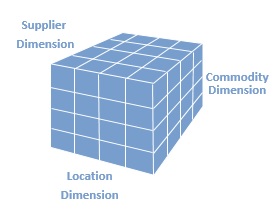

Spend analysis precedes strategic sourcing. It organises spend via defined dimensions (see Fig 1) to create a cube, such as category and supplier, etc. in order to:

- Develop a true category spend baseline

- Identify strategic sourcing opportunities

- Identify opportunities through increased compliance, maverick spend control and contract compliance, etc.

However, implementing spend analysis is not easy and takes significant effort and commitment in order to overcome the challenges, especially the first time spend analysis is attempted. Challenges over and above those already detailed include:

- Spend Knowledge: many organisations do not understand the challenges in dealing with fragmented data or don’t have knowledge of supply markets to map spend across the organisation.

- Executive Support: is critical to obtain the necessary budget and resources.

- Advanced Analytical Capabilities: These are required to extract and cleanse data to perform the spend analysis. It requires highly capable people skilled in the use of advanced analytical tools.

Once Spend Analysis has been successfully completed, there are a number of tangible actions that follow with regard to developing sourcing strategies. These actions include building category specific datasets, identifying areas for demand management, monitoring contract status, detecting fraud, and conducting an opportunity assessment.

2.3 Opportunity Assessment

Find and prioritize procurement initiatives tied to businessstrategy

When conducting a strategic level opportunity assessment, procurement personnel must understand their organisations business strategy. Further, the Senior executives must accept that sourcing:

- decisions are strategic and can drive significant organisational change and;

- strategy should directly support long-term goals

With these conditions in place, in addition to financial information, an opportunity assessment should cover all of the non-financial information that is required for good business decision making such as:

- Governance around the process or category

- Degree of market difficulty

- Risk exposure to the business

- Important contract considerations

- Procurement management penetration

- Complexity and dynamics of the category business requirements

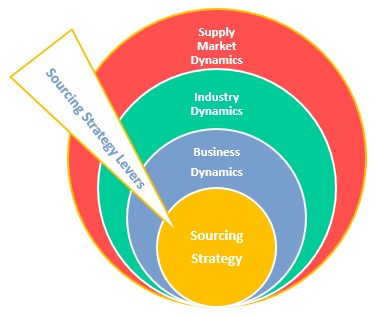

The opportunity assessment is conducted around four primary dimensions (Fig 2).

All too often such a rigorous assessment is not conducted, which represents a major loss of value to shareholders and stakeholders alike. A rigorous opportunity assessment provides the critical information necessary for the prioritisation of sourcing programmes that create value via an effective sourcing strategy.

3. Sourcing Strategy

Detail the business case for how business requirements will be met and savings made

A sourcing strategy answers, at board level, questions relating to strategic cost and risk management on two levels:

- Business Process Level: which processes should or could be outsourced (or centralised internally via a shared services model) and those which should stay in-house, based upon long-term business objectives (Insource – outsource)

- Category Level: The priorities for sourcing or resourcing categories from external suppliers

The outputs are identified business processes that could better support business objectives by being sourced differently and an ongoing programme of sourcing activity for all categories of externally sourced spend.

The sourcing strategy systematically identifies sourcing initiatives as an integral part of the business planning process. It should address the business case, governance, change strategy, risks and opportunities and organisational readiness. The major benefits to this approach is to have a coherent plan for:

- Making the organisation more competitive

- Increased agility

- Integrating the core competencies of external suppliers in achieving business goals

- Supporting business growth

- Optimising cost

The impact, of a sourcing strategy on the organisation, is significant and so must be carefully aligned to the achievement of business objectives.

3.1 Developing a sourcing strategy

Sourcing for value and competitive advantage

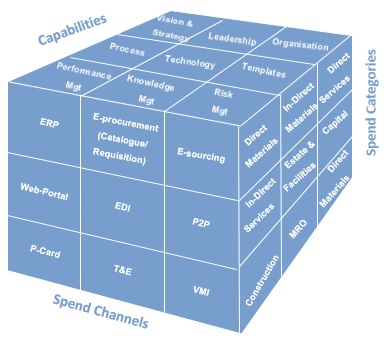

In order to develop a successful sourcing strategy for a business process or category, procurement needs to understand the role and objectives of each in supporting business strategy. Procurement must also assimilate knowledge from external markets and bring these together to form a unified sourcing strategy, Fig 3. The sourcing strategy then defines in a series of mini-business plans, how the business process and category strategy will meet the ongoing targets, goals and objectives of the business.

The sourcing strategy must, therefore, provide a core framework, yet be flexible enough to adapt to changing business demands. It must facilitate agility, led by business drivers and address real problems to deliver tangible business benefit from systematic strategic sourcing and supplier management initiatives.

3.2 Strategic Sourcing – good for your business?

A key success factor for all businesses

Savings in the range of 5 to 25%, and in some cases more are achieved by applying four key attributes:

- Process Clarity: provides the execution discipline to handle key sourcing decisions

- Analytical Rigor: provides fact-based information to ensure maximum value from supply markets. Including, company requirements, supply market capabilities, market engagement strategies, supplier selection methodologies and negotiation strategies.

- Total Costs Approach: by going beyond price and addressing quality, service, delivery and all other components of total costs or value

- Broad-based Decision-Making: procurement does not make contract award decisions in isolation. Decisions are cross-functional, and in the most advanced organisations subject to strict governance controls that ensure any contract award meets organisational goals.

These four attributes highlight the primary distinctions between strategic sourcing and traditional purchasing and identify some of the underlying challenges faced during implementation.

3.3 Implementing the Strategic Sourcing Mandate

A highly visible and active commitment by senior executives is mandatory for success

Without it, little will change, sustainable results will not accrue and disillusionment will rapidly set in, both in the wider organisation and amongst procurement staff. The necessary executive commitment must cover at least the following:

- Mandating procurement accountabilities that support the ‘desired state’ model, objective analysis and recommendations for the organisation as a whole, eliminating ‘no go areas’.

- Investing resources to manage and lead the programme.

- Actively supporting compliance with sourcing contracts and terms.

- Visibly endorsing the strategic sourcing programme in employee and management meetings, company publications and, where appropriate, external media.

The ability to achieve momentum for change requires a change plan that drives change at a pace that the organisation can readily digest. It requires, cross-functional credibility through early successes or even injecting a catalyst for change by utilising experienced external consulting capability.

4. Implementation Roadmap

Strategy without implementation is just wishful thinking

When an organisation commits to implementing a strategic sourcing change programme, there is a ‘window of opportunity’ for those leading the change. This window will close in six months or less unless the senior executive sees a roadmap for change and the functional heads have a clear understanding of the benefits to their respective functions. This roadmap must be ratified by the executive as the vehicle for change.

4.1 From the Negotiating Table into the Bank

Savings are the most important deliverable in the sourcing process

To effectively capture savings, savings tracking is critical. You need to be able to measure the results achieved against the original plan. It requires focused commitment, to understand why savings were or were not achieved, or maximise their capture. To address this the most sophisticated organisations:

- Measure results achieved and identify the areas of leakage

- Implementing compliance measures that are easy to track/review

- Set savings targets integrated into managers performance review

Effective performance management and tracking systems enable variances to be categorised to changes in; volumes, what was purchased, and the suppliers used. Take corrective action to stop leakage or ensure financial results and expectations are realistic and explainable from the use of fact-based information.

Only by developing the capabilities to effectively control the channels applied to each category of spend can an organisation maximise savings capture, Fig 4, and ensure negotiated savings move from the negotiating table and into the bank.

5. Conclusion

The power of strategic sourcing is compelling

For some organisations the impact of a 10% reduction in the cost of goods and services is the equivalent of increasing revenues by 25%. Unfortunately, many of the benefits don’t show up in the bottom line due to ‘leakage’. Leakage occurs because the capabilities necessary to convert contracted savings into ‘realized savings’ are not developed.

While savings is a major benefit, it is not the only benefit from strategic spend management. It also provides a focus for operational excellence via improvements in internal and external compliance, process efficiency, reduced inventory & cycle times, faster delivery, higher quality and increased innovation.

It provides a systematic, approach to managing cost strategically especially when applied as part of developing a core organisational capability in supply management. It is the means to deliver the year on year savings so desired and sought after by CFO’s and does so with little risk and quick results. Such capabilities, increasingly differentiate those organisations able to compete effectively and remain in charge of their destiny from those who will fall prey to more agile, able competitors.

Nuff said …