Aligning CFO and CPO strategy to manage organisational debt

The Brave CPO: Deleveraging Organisational Finances. A guide for CEO’s, CFO’s and CPO’s to improve liquidity, credit ratings and borrowing capacity

What’s in it for you?

Strengthen balance sheet and finance fundamentals

Reading time:

10 minutes

1. Introduction:

As many industries still struggle to find indicators pointing towards sustainable economic recovery, they face uncertainty over future growth and how to manage the lengthy process of debt reduction, or deleveraging; that will apply a drag on growth and an increased focus on financial viability.

Leverage is still very high in some sectors such as commercial real estate and mining; companies have leveraged acquisitions in the years before the collapse in commodity prices. For many, while interest rates remain low, they enjoy the benefits of cheep credit. If rates creep up however, investors might start to worry about the companies with the most debt, who are vulnerable to income shocks forcing distressed asset sales to remain viable. As a consequence, these organisations are focusing on cost containment as never before. Enter procurement.

2. Aligning Finance & Procurement Strategy

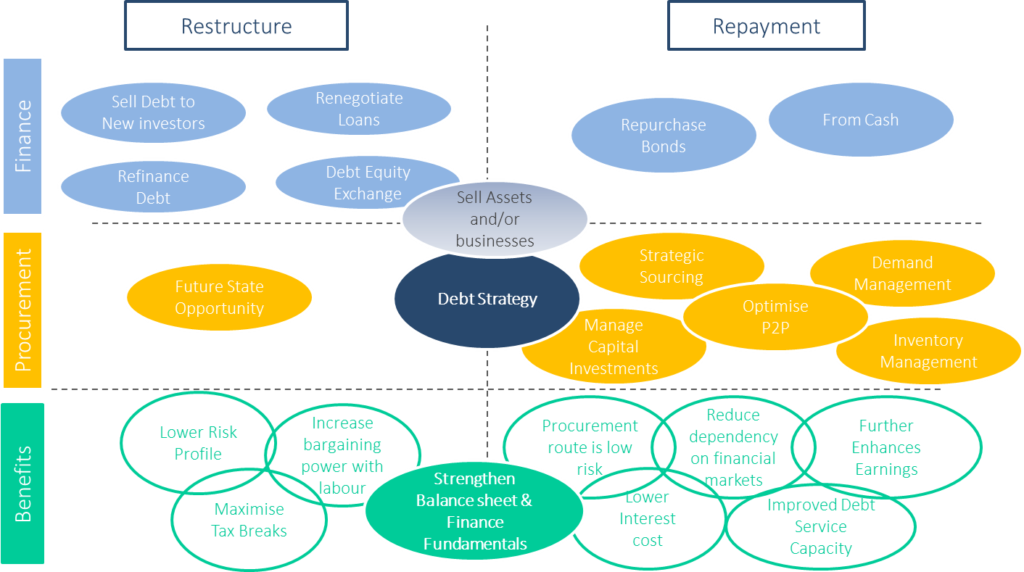

CFO’s have two options when seeking to deleverage their organisation’s finances; restructure or repayment. See Fig 1. While the CFO may claim ownership of the restructuring domain, the CPO can stake out their role in any strategy to repay debt. By collaborating, to develop a joint debt plan the CFO and CPO can provide faster and more productive outcomes than either of them acting alone.

CPO’s should, therefore, understand their CFO’s policy towards the organisations capital structure and develop procurement strategies aligned to support it.

2.1 Procuring Cash Flows

The organisations capacity to generate cash from operations, asset sales, or external financial markets over its cash needs, determines its ability to repay debt.

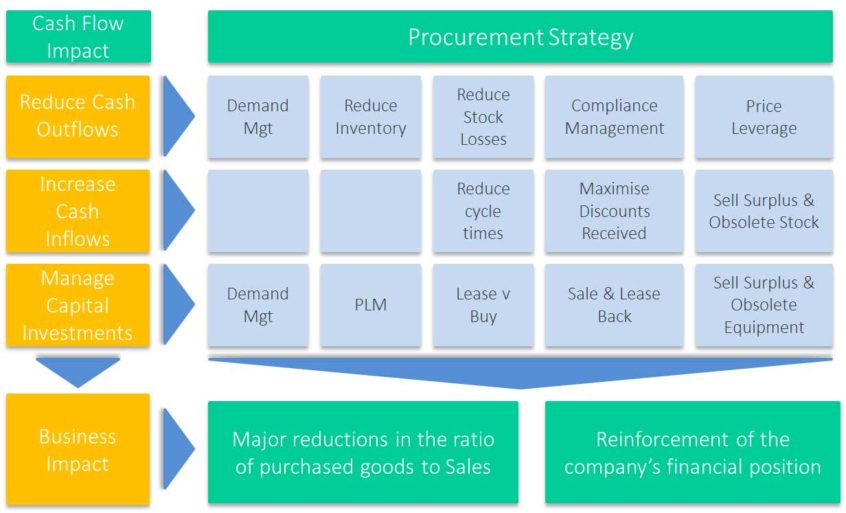

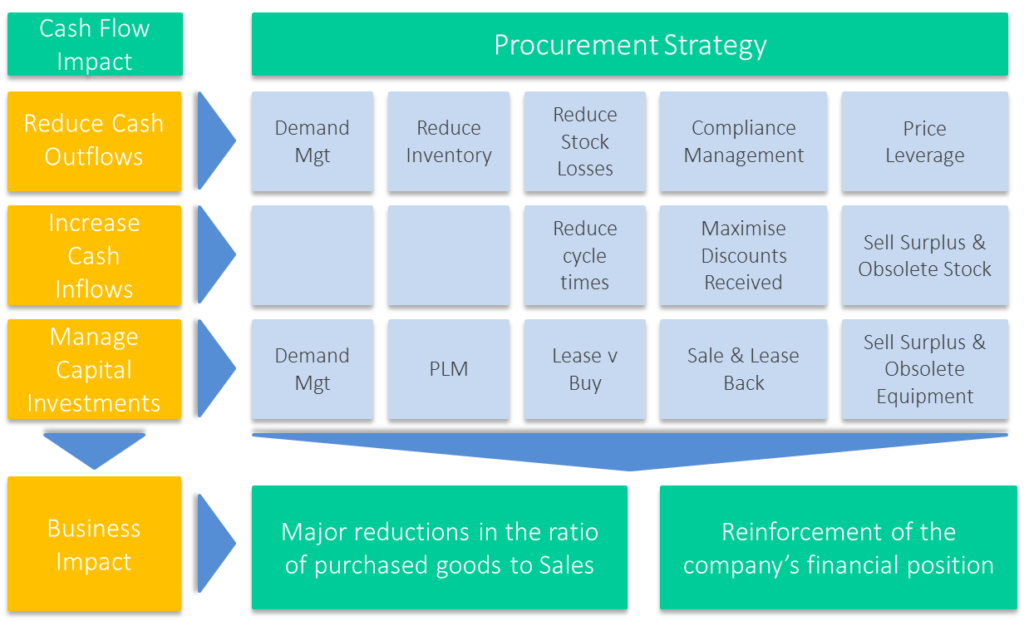

Procurement activities primarily impact cash flows from operating activities which with careful management can reduce the need for CFO’s to resort to distressed asset sales. It is useful therefore for procurement to view its actions concerning their impact on cash flows. Fig. 2.

Procurement’s role is to free up cash, reduce capital employed and reduce cycle time in the supply chain to improve liquidity and support borrowing capacity. Fig 3:

2.1.1 Free up Cash:

Procurement reduces cash outflows by improving supplier terms or reducing inventory to release cash, similarly increasing cash inflows via the sale of obsolete stock and equipment generates cash.

By negotiating improved terms with suppliers, procurement effectively creates free finance to help repay debt or fund future growth. The management of capital investments via optimising life cycle cost and lease vs. buy etc. can also free up cash significantly.

2.1.2 Speed up Cash Cycle times:

Procurement can either get money to ‘move faster’ around the operating and cash conversion cycle or reduce the amount of money ‘tied up’ in it. Both ways, either more cash is released or borrowing needs to fund working capital are reduced. Consequently, organisations can choose to pay off debt to lessen the cost of bank interest, which in turn increases EBT or have additional free cash available to support further sales growth or investment.

2.1.3 Improve Debt Capacity:

By improving operating cash flows, asset sales and cost, procurement increases EBITDA and improves the capacity of their organisation to borrow. Conversely, weak EBITDA can adversely impact the company’s liquidity and hence credit facility, which decreases borrowing availability, while suppliers are also likely to tighten payment terms.

2.2 Savings Capture

Before the CFO has the confidence to allocate procurement savings to service debt to shorten the finance term, they must have the confidence that reported benefits will flow to the bottom line. Critical to gaining confidence is creating visibility into the savings process and successfully managing the link between finance and procurement. To make this happen requires a formal savings process incorporating the following features:

2.2.1 Systemised tracking

The procurement and finance function must accurately track the overall progress of cost savings. Capturing them in a project log incorporating an agreed baseline against which benefits are measured. Establishing this tool provides the means to monitor procurement’s progress and compare it with established milestones.

2.2.2 Linking procurement savings to departmental budgets

Savings become embedded into budgets based upon contracted savings measured against the agreed baseline and assumed levels of demand signed off by the budget holder.

2.2.3 Tracking of estimated savings through to realised savings

Significant variances between budgeted savings and realised savings can occur due to changes in demand, currency fluctuations, etc. So realised savings are very different to budgeted savings. Based upon the actual invoiced goods and services value measured against the defined baseline. Variances need to be normalized as appropriate to evaluate procurements impact.

2.2.4 Category specific savings rules & dashboard monitoring

Savings rules must be category specific, conducting monitoring at the category level due to the high level of complexity, different levels of granularity, category specific elements and case by case decisions.

The savings measurement process must overcome these challenges by observing the following requirements:

- Exhaustive and flexible savings rules to allow for future changes and developments

- Ease of understanding and use, balance between consistency and applicability

- Rules and tools accepted by all budget holders

- Fact-based, trusted figures reflecting the actual impact and building credibility

- Organisation-wide consistency, treating similar scenarios similarly across all entities

2.3 Metrics

- Debt to Equity = Current Liabilities + Long Term Liabilities/Shareholder Equity

- Debt Coverage = EBITDA/Debt Service

- Free Cash = EBITDA – Debt Service

3. Conclusion

While many organisations have been forced to resort to asset sales to survive the downturn, further deleveraging is likely to be a key focus for many. Procurement can play a vital role in this process if the proper capabilities are invested in, which in turn will strengthen the overall financial performance of those organisations who do so. This includes developing a robust savings process and framework to ensure savings impact the profit and loss.

Collaboration with finance is critical for success, so the CEO should make sure the CPO and CFO are working side by side towards agreed corporate goals. Organisations that achieve this will, in future benefit over those who do not through stronger balance sheets, improved cash flows and better than industry norm margins and borrowing capacity. Creating opportunities for buying up distressed asset sales from weaker competitors.

The key question is what kind of procurement operation will have the capabilities to go beyond incremental cost savings to generate the transformational performance improvement that can significantly reduce leverage? Not one driven by day to day operations, reporting at a low level in the organisation and lacking leadership and support from the very top.

Nuff said…