Managing Procurement Through a Downturn:

Managing Procurement Through a Downturn:

Managing Procurement Through a Downturn – A guide for CEO’s, CFO’s and purchasing leaders on Surviving the Tough Times though Procurement Excellence

What’s in it for you? Create opportunities to out-manoeuvre your competitors by building sustainable competitive advantage, and prepare for the next growth phase.

Reading time: 15 minutes

Introduction:

Economic downturns typically are accompanied by large inventory build-ups and cut-backs in orders which cascade down the supply chain, often having a devastating effect on unprepared suppliers.

In such a climate businesses large and small cannot afford to wait and do nothing. A typical response might be that sales are good, and costs are bad, followed by a financial crack down, to limit the damage to the company’s market capitalization and the level of shareholder dividend payments? In other words, get back to financial basics.

At Purchasing Practice, we don’t believe this is the right solution. We believe in a more strategic approach to cost reduction. Some costs are good because they are a vital component that drives current and future growth. Cutting these too far or in the wrong places can have a catastrophic impact on a business.

It is the role of strategic cost management programs to consider all types of cost, good, neutral, and bad. This assessment can then be used to target cost more effectively and reinvest any savings back into the business. Strategically, businesses can create opportunities to outmaneuver competitors who carry on with business as usual or are unable to adapt quickly, except by wielding the axe and cutting staff.

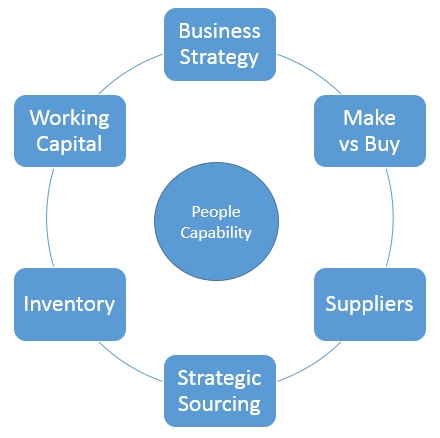

So how does Purchasing Excellence help?

We know from previous downturns that procurement plays a key role in any cost reduction initiative. At Purchasing Practice we believe procurement leaders must use this opportunity to not only cut cost but also build sustainable competitive advantage:

Know your business:

Procurement staff must understand the company’s business strategy, its objectives and what’s important in order to gain a better understanding of its strategic imperatives and business drivers.

Stakeholders:

Procurement must ensure close alignment and forge alliances with key stakeholders across the company and focus on the issues that are most important to the company. It is no use asking stakeholders, ‘How can I help you?’…they may not know!

Procurement must take the lead and as successful procurement leaders know one of the biggest mistakes procurement can make is trying to be all things to all people.

By considering how the wants and needs of stakeholders align with what the organization wants and needs from its stakeholders, procurement can examine its relationship with each stakeholder. Procurement can then assess the strategies, processes and capabilities needed in order to satisfy these two critical sets of wants and needs.

1. The battle for talent:

In the end, transforming procurement into a competitive advantage depends on winning the battle for talent.

Procurement talent is in short supply across all sectors and major organizations globally are finding it a significant challenge to recruit and retain highly skilled experienced procurement staff. So overzealous cutting can be detrimental to employee morale and increase turnover, sending top performers into the hands of competitors and can leave your organization in a weakened position.

With both the shortage of talent and increased internal financial constraints during a downturn, companies cannot depend on hiring to fill the talent gap; businesses have to develop the skill levels of their existing staff.

Invest in Training

One lesson from the 1990s downturn is the threat to staff morale caused by lay-offs and redundancies among the remaining employees. This syndrome called “survivor guilt”, and those survivors are often less productive and preoccupied with the short term. Consequently, their behavior becomes highly risk averse, and innovation stifled.

Surveys have found, however, that companies that increased their training after announcing lay-offs were twice as likely to report improved profits and productivity as the firms that did not invest in expanded training. Training and development recognise and values employees, and helps survivors move on and respond to the new environment.

Review the staffing mix

World-class procurement executives build organizations that have a much more strategic staffing mix than typical companies. According to past research from Hackett, world-class procurement executives build organizations with 63% fewer clerical staff and 31% more professionals. The staffing model plays a key role in enabling world-class procurement organizations to perform very differently than typical companies. World-class procurement organizations spend 20% less on operations than peers and have about half of the overall staff.

2. Suppliers:

A prolonged industry downturn is typically accompanied by increased supplier instability. Unfortunately, it is still true to say that many organizations do not know enough about their suppliers. It is particularly important to do so in a downturn as supply risk can have an even greater impact on a company’s success.

A proactive and predictive strategy is required towards supplier risk management. CPO’s must understand the realities of their suppliers, partners and the supply chain as a whole, to determine the impact on the organization if they cannot fulfill their obligations. So how do you manage the risks of procurement?

Collaborate for success

In order to benefit from collaboration, it must be managed both effectively and selectively. The wrong approach to collaboration may increase costs instead of cutting them, create confusion instead of clarity and drive suppliers away.

Examples of collaboration include, joint training and development in such areas as lean processes, data analysis, common systems and aligned metrics. Cost reduction targets, warranty claim reduction and continuous improvement activities.

Collaboration requires sharing information freely and transforming this information into knowledge, and then creating value from that knowledge. The ability to create value from knowledge depends on relationships.

Relationship Management

Profitability and efficiency are increasingly being driven by good supplier relationship management, working closely with suppliers to achieve corporate objectives. Managing supplier relationships is vital because it allows companies to create value from their intangible assets. Strong supplier relationships can also help drive innovation as it is often the supplier that can identify opportunities for improving processes or providing new materials.

More strategic approaches are needed

For the buying organization, the purpose of investing time in a relationship with a supplier is to ensure optimized performance of that supplier towards the business objectives. Alternatively, if a supplier hasn’t been performing satisfactorily, to instigate improvement measures.

Supplier relationships can be categorized depending upon their strategic importance to the organization. Setting a clear framework by which to determine the appropriate intensity of the relationship and how much time and resource is committed to managing the relationship is vital.

A relationship, for example, could be deliberately kept at a distance but remain good; this could be because there will be no immediate business benefit from having a closer relationship. For example, when the goods or services being supplied are relatively low value, infrequently required and pose very little risk to the organization should the security of that supply ever break down.

Moving to the other extreme is the long-term close relationships operated as a partnership. Often it is the case when items are high risk, high value and critical to maintaining operations.

Examine supplier finances

A general economic downturn may put some of your suppliers at risk of financial problems. A review of the financial condition of all key suppliers should be conducted, along with closer monitoring of the financial status of these suppliers through the downturn.

Renegotiate contracts

A downturn in your business will reduce your requirements for goods or services. Review your volume commitments to suppliers under longer-term agreements, especially take-or-pay type agreements, and be proactive in discussing changing requirements with suppliers. Also, be alert to potential changes in inflation when drawing up contracts.

It helps benefits both buyer and supplier to mitigate risks and insulate against the negative impact of a downturn. Share the pain to survive, get serious discussions moving with critical suppliers to share risks and rewards, reduce cost and improve efficiencies in a downturn as well as to prepare for the next growth phase.

3. Strategies:

Manage Your Cost Structure and External Spending:

Take care when cutting cost. Too often, companies focus on short-term cost reduction, which can result in higher costs over the long term. Common mistakes include:

- Cutting costs in areas critical to future growth and success

- Eliminating costs without addressing root-cause issues, such as inefficient business processes

- Cost-cutting decisions based on assumptions rather than fact based data.

Any business must incur costs to remain competitive. Sound cost management is not just about reducing short-term costs and increasing efficiencies, it is about achieving sustainable competitive advantage. Timely, accurate information makes the difference between a decision and a guess. Supply executives who have a thorough knowledge of their organization’s cost structure and third party expenditure are better positioned to make informed decisions about cost management.

Strategic Cost Management Strategies in Procurement

Structuring for Strategic Cost Management requires understanding the Cost Drivers and laying down clear guidelines for how to proceed when first embarking on a cost management program. As you move forward, the task becomes more complex as easy targets have been identified and executed, and more difficult cost opportunities present themselves.

Typical stages of cost management in procurement are; price drift, price down, cost down, cost out and value add. As companies progress, they move from focusing on reducing the cost to removing cost and to adding value. To be successful, they must employ increasingly sophisticated tools and techniques, including selecting appropriate supplier relationships and then managing the relationship effectively. Typical tactics may involve simplifying specifications and cutting process waste.

4. Launch a Strategic Sourcing Initiative:

Since the early 90’s, we’ve heard many examples of the large and sustainable benefits that can accrue when strategic sourcing is applied to attack supply cost.

What is strategic sourcing?

Strategic sourcing is a collaborative and structured process that can dramatically reduce external spending. It is a high-reward, low-risk alternative to traditional cost-reduction initiatives.

Strategic sourcing starts by meticulously defining the requirements for a product or service, and continues through the contracting process, followed by ongoing monitoring of the supplier’s performance against the defined requirements. By definition, it is very straightforward and common sense, in practice it requires skilled leaders to manage the shift in the organization from a traditional procurement organization to a world class procurement organization.

The benefits of strategic sourcing

It benefits the entire organization by reducing cost, optimizing resources, drives standardization and supports compliance while improving quality, internal processes and lowering total cost. Once realized, sustain savings through benefits tracking, supplier relationship management, and stronger purchasing capabilities.

5. Manage Inventories:

Typically, business downturns are accompanied by significant build-up and subsequent write-offs of inventories. Take this opportunity to review materials-planning policies, reduce existing inventories, and re-examine prescribed inventory parameters.

6. Manage Working Capital:

Companies striving to improve the way they manage working capital are often handicapped by paper-based, manual invoicing processes that result in lengthy invoice cycle times. Consequently, it is difficult to qualify for and capture early payment discounts. Because so much time and energy are used to process invoices, they are unable to devote the resources needed to work with suppliers more strategically.

Multiple groups, including treasury, finance, AP and procurement, impact an organization’s ability to manage working capital effectively, but often work in silos. While each of these groups has its goals, the entire organization must be aligned to gain maximum working capital efficiencies. For example managing Days Payable Outstanding and paying suppliers early to capture discounts, must be carefully balanced if an organization is to make optimal working capital decisions.

7. Procurement Excellence – Does excellence matter?

Excellence is no accident…. World-class organizations operate and perform very differently than their median peers, reports Hackett. They found that World-Class Procurement Drives 133% greater return than typical companies but cuts cost of procurement by 20%. They calculated returns by dividing spend savings (spend reduction attributable to procurement practices) by the total cost of procurement operations. This advantage translates to $3.6 million to the company’s bottom line for every $1 million in procurement operations costs.

8. Leverage the Power of Technology:

Many companies have external purchases of up to 60% of their overall annual turnover and in some cases even higher. E-procurement deployment can help better manage this spend by creating significant process savings and lowering the absolute cost of the goods and services by ensuring compliance with strategic procurement initiatives.

Benefits:

Improved procure to pay processes resulting in increased compliance with strategic procurement contracts and reduced maverick spending

- Increased spend visibility

- Improved working capital management

- Improved contract management and supplier relationship management resulting in improved monitoring of the suppliers performance

Delivering these benefits may involve a combination of technologies, such as an e-marketplace for ordering goods and procurement cards for their payment, e-auctions for sourcing initiatives and automated contract management systems, etc.

Achieving the benefits of e-procurement will require the updating of current practices towards best practice. Change management is, therefore, critical to the success of e-procurement.

9. Drive compliance and track savings:

During a downturn preventing maverick spending and leakage from negotiated contracts becomes even more important. One key performance indicator is whether an organization is on track to achieving their procurement savings initiative goals gained from strategic sourcing and other purchase cost reduction initiatives.

The information associated with these initiatives is a critical input for annual savings reviews and management reports that communicate savings data to company executives and financial analysts. Unfortunately, most organizations face problems in being able to track the transactions associated with each savings initiative and have the necessary information available for immediate analysis to take any necessary corrective action. A savings tracking solution that integrates into an organization’s sourcing infrastructure can deliver the necessary data to help drive compliance and cut maverick spending.

Conclusion

Company executives and Procurement leaders should be proactive in developing strategies for how they might meet the challenges of managing through a downturn.

While smart businesses are prepared to take defensive measures that will limit the short-term damage, best in class businesses turn the challenge of a downturn into a long-term advantage by building stronger customer and supplier relationships. Best in class companies, therefore, understand that superior performance requires preferential treatment from both customers and suppliers.

On the supply side, this means investing to win the battle for talent, developing a world class procurement team and business practices and deploying the technology to support them.

Nuff said …