M&A Procurement Capabilities: Due Diligence

Part 2 – Due Diligence

M&A Procurement Capabilities: Due Diligence. A three part guide for CEO’s, CFO’s and CPO’s to assess how procurement can make a critical difference to capturing the value in M&A

In Part 1 we discussed how M&A value is created and the procurement capabilities required to capture it.

Here in part 2 we discuss pre-planning and due diligence.

1.Time is of the Essence

Procurement must get involved in the planning stages. If it does not, it can subsequently take months to do the detailed supply-side analysis. At the worse you will have lost the momentum and the opportunity, and at best almost guaranteed sub-optimal supply side performance and increased the risk of disruption.

Action must start on day one and one way for procurement to prepare for this is by developing a first 100-day plan.

1.1 First 100 Day Plan and Evaluation (F100D)

The F100D after the signature will make it clear who is in charge at a time when new information is being discovered, and conflict over assumptions, resources, style, and roles is frequent. Procurement should establish an integration task force supported by clear governance to drive delivery of an early wave of targeted and ambitious sourcing improvement projects, aligned to the value drivers of the integration and overall company strategy. To do this procurement must develop a detailed procurement plan for the F100D and beyond including; quick wins, accelerated sourcing programs, full strategic sourcing programs and supplier development goals.

2. Due Diligence

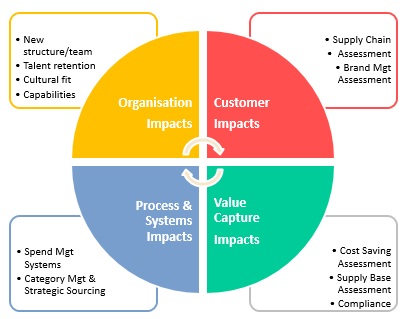

Due diligence is essentially an exercise in procurement risk management. The most critical due diligence supply side issues for procurement are:

2.1 Organization Impact

The creation of a new organization presents opportunities to implement more efficient and effective control structures. It is very natural for the acquiring company to think its model fits all. But it’s important to keep an open mind and to share procurement best practices. If we are not open to best practices in on both sides, it will hurt the integration because you get into a fight as to the best way to do things.

2.2 Customer Side Impact

Customer centric procurement delivery models must be merged as quickly as possible, both to realize planned synergies and to minimize potential costly disruption to customers. So while it is vital to ensure that cost savings are captured, plans must also be made to integrate the supply chains by considering key service-oriented metrics such as quality, inventory turns and order-fill rates. Such a plan will help minimize supply disruptions that can compromise much of the targeted synergies by potentially compromising service and at-risk accounts.

a) Supply Chain Assessment

In order to establish alignment, the key industry performance metrics need to be assessed. For a typical manufacturing company these might include:

- Cost per shipment: for both inbound and out-bound logistics

- Quality: which can be measured in terms of returns from customers

- Delivery: in terms of fill rate and perfect order performance from the supplier and to the end customer

If synergies between two supply chains exist, then that must reflect on some or all of these metrics.

b) Brand Management Assessment

Procurement and Marketing must make plans for managing branded product introductions and run outs, such as vehicle livery, websites, signage, and stationery.

2.3 Value Capture Impact

By taking a preemptive view of the potential supply side synergies, procurement can make an important impact on the valuation decision.

Procurement knows which its top suppliers and contracts are and where it can create value for shareholders and earn back the price paid for the acquisition. By developing well-defined processes to assess procurement’s impact on M&A valuation procurement can prepare itself to capture identified synergies swiftly post merger:

a) Contract Management Assessment:

Those organizations with a well-managed contract management process are best placed to ensure contractual commitments are optimized. These organizations can quickly produce a list of contracts that has to be amended, re-priced, and re-negotiated or to be terminated, feeding directly into a sourcing strategy.

b) Sourcing Plan Development:

By having a clear sourcing strategy from day one, procurement can ensure the optimum phasing of supply side synergies, from quick wins through to longer term synergy potential. A well-developed category organization facilitates rapid integration and strategy execution.

c) Supply Base Assessment

Some of the expected synergies may not be realized if supplier relationships are not handled well. Those organizations with a well managed supply base comprising preferred suppliers with strong business relations are best positioned to achieve savings quickly.

2.4 Process & Systems Impact:

Here the drive is to go from two organizations to one as quickly as possible. For Procurement, the first step is to get your spend cube loaded with the other parties data so that you can see what they are spending through spend analysis. From an IT perspective, the focus is typically on core ERP implementation that is likely to take longer.

With due-diligence completed you are ready to integrate the two organizations.

Nuff said …

In part 3 we discuss integration