The Brave CPO Optimizing Cost for Value Generation

The Brave CPO optimizing cost for value generation starts by linking procurement strategies to business goals. By developing a much deeper understanding of their organization’s cost structure and a more strategic approach to managing cost. Their organizations can avoid damaging panic cost reduction programs in difficult times.

1. Introduction:

Their organization’s ability to compete over the long term is a crucial concern to CEO’s everywhere. Those organizations that have successfully steered their way through the economic cycles of recent decades have maintained their investment in value producing assets (capital, people, functions, processes, etc.). These assets are the foundations of any organization. It is possible to improve them, but to cut too deeply or in the wrong places damages the long-term stability of the organization’s structure. The result is the loss of value to shareholders and other stakeholders.

The battle for the customer has never been so intense, and only those companies who deliver the promised value will win. Those CEO’s who view demanding customers not as a threat, but as an opportunity to differentiate can secure a competitive advantage over their competitors. They do this by focusing on enhancing customer value while eliminating costs that do not match customer requirements.

2. The ‘Brave CPO’ & Cost Management:

The core business strategy provides the drivers for managing cost. So any cost management strategy must be linked to strategic plans and performance goals. CPO’s must, therefore, understand, ‘Where their organization wants to go?’, ‘What it needs to get there?’ and, ‘How their organizations cost base supports the delivery of the business strategy?’

By influencing their company’s strategic cost and differentiation decisions, CPO’s can better define the strategy to manage the cost associated with the delivery of the business level strategy. A more strategically aligned approach is as much about the expenses you keep as it is those you cut.

CPO’s must evaluate how their organization can manage costs effectively and avoid the pitfalls of cutting too deeply or in the wrong place, by understanding which cost add value to the business and which don’t. Previous research has helped categorize cost as either good, neutral or harmful.

2.1 Good cost

Are those essential to driving current and future growth. Cutting these too far or in the wrong places can have a catastrophic impact on business growth and profitability.

2.2 Neutral Cost

These costs are those that do not drive growth or provide a significant opportunity for cost reduction. They do, however, support the company infrastructure and delivery channels to the customer.

2.3 Bad Cost

CPO’s must get engaged in their organization’s strategic cost management program and develop processes to review their organizations “cost,” not just spend. This assessment can then be used to create a strategic cost reduction program and identify savings for reinvesting in the business.

3. Why many cost reduction programs fail?

All companies, launch cost-cutting programs in bad times and, less frequently, in good times. When done in isolation by setting arbitrary targets that do not reflect their basic needs, strategic objectives, or the organizational structure. The effects are often detrimental to long-term results and fail to deliver the short-term benefits anticipated.

3.1 The dangers of across the board cuts

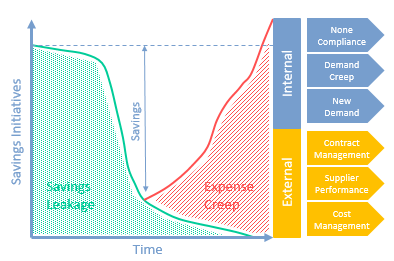

Across-the-board cuts can adversely affect service levels to valuable customers who then switch suppliers, which in turn reduces critical volumes and has adverse impacts on profitability. Consequently, many cost reduction programs are attacked by internal detractors and abandoned. Sometimes, programs generate a substantial initial payback. However, they then encounter deteriorating long-term results and decreasing focus on cost-cutting and efficiency improvement, notably when the economy improves, and customers start spending again (See Fig 1).

3.2 Typical issues

There is no single or simple answer to why so many cost reduction efforts fail, but many CPO’s will be familiar with the following:

- Inadequate governance structure to run an effective program and balance risk with reward

- People assigned to the initiative lack the necessary skills or are diverted too quickly into other assignments

- Cutting key capabilities leads to lost value and adding back costs

- Implementation delays reduce and slow down realized savings

- Savings are poorly calculated or double-counted and not tracked

3.3 Future Success

Those organizations who drastically cut cost often emerge less well prepared for an upturn with damaged competencies, lost knowledge and lower morale. Those that buy up cheap assets explore new markets and forge closer links with customers and suppliers do better.

CPO’s need to develop the capability to control costs over the business cycle, not just in hard times. Making sure they understand the strategic impact and sustainability of their cost-optimizing actions.

4. Making the Link with Financial Markets

Business is now under “real-time” scrutiny by stock market analysts, who monitor, review, and analyze a wide range of operating statistics for publicly traded companies on a daily basis. They reward companies with higher stock market valuations who;demonstrate higher levels of productivity and efficiency, and review cost reduction measures with them.

Stock markets place a premium on productivity and efficiency. The key to maximizing shareholder value, therefore, is increasing the efficiency of operations, not by achieving a single goal, but by continually improving operating efficiency. Procurement and the supply chain represents a critical component of operating efficiency, and the CPO must develop strategies that link to capital market expectations.

5. Strategic Cost Optimization Process:

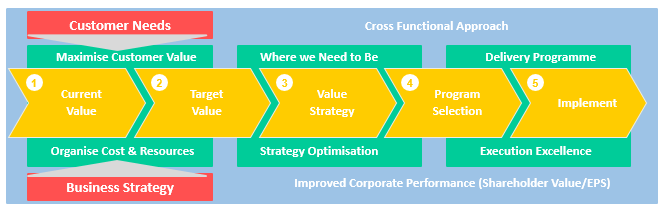

Put your hand up if your company has a formal cost optimization process? Keep your hand up if your company involves procurement as a core part of this process? Chances are; there are now not many still holding their hand up. The ‘Brave CPO’ can capitalize on this lack of a formal process by leading the call to develop one in their organization and claiming the lead role. Fig 2 shows a suggested approach:

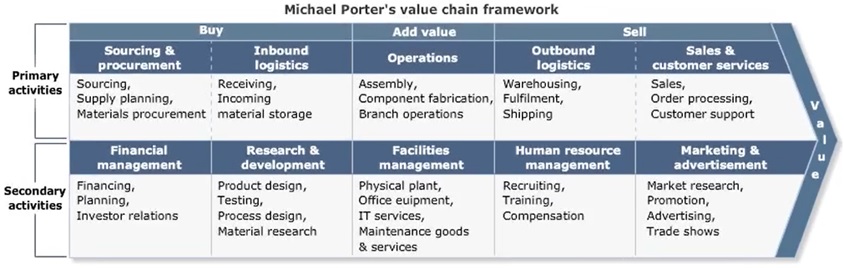

5.1 Business Strategy Evaluation

The first phase is to review the current business strategy to ensure that it offers the best solution to meeting customer needs and expectations. To establish this, we typically identify customer segments, as well as the services, products, channels, and resources they use. By understanding the company’s customer base and the distribution of value or service, we can evaluate the distribution of cost and take actions to optimize the cost base.

5.2 Data Analysis is crucial

A cost optimization program is only as good as its data. So companies need to gather and analyze detailed data to establish a current cost baseline. Also, they should understand the history of management decisions that led to the current cost structure.

The information gathered, will enable other vital questions to be addressed:

- Which products and services do our most attractive customers value and how effective and efficient are we in delivering them?

- What percentage of our resources are consumed by customer segments of marginal value, and how can we reduce that percentage?

- Which services should we outsource to more efficient providers?

- What product, customer segment, or channel areas should we exit entirely?

5.3 Strategy Optimization

The next phase is to define the initiatives as part of any cost optimization program. It will be evident from analyzing the gap between the current value position against the targeted value position. It is essential to define, at a high level, the cost targets and expected economic and operating environment the business needs to support the targeted value. Then the task is to align the company’s cost optimization and differentiation initiatives with the reconfirmed strategy. Rather than across-the-board cuts likely to undermine business objectives.

This list of potential initiatives could include examining best practices, process re-engineering, outsourcing, investment projects, strategic sourcing initiatives, staff cuts, etc. They must then be prioritized to produce a portfolio of short-term and long-term plans. Using criteria such as the investment required, potential benefit, the difficulty of implementation, risks involved and ultimately the urgency and appetite within the organization for the fundamental changes needed to increase efficiency. See Fig 2

5.4 Delivery Program

This phase requires solid visible executive support. A necessary ingredient for achieving results is an expectation CPO’s can efficiently execute. Too many change projects fail because of, poor governance, inadequate skill sets, political infighting, or “analysis paralysis.” A company’s ability to execute is, therefore, critical in generating real sustainable value. A “can do” mentality is not enough on its own. Companies must embrace and support programs, by ensuring they are well resourced with highly skilled people able to deliver the quick wins while simultaneously driving change in areas that offer a more significant opportunity for improvement.

6. The Case for Procurement

6.1 Bind Procurement firmly with corporate strategy

Value-based procurement strategies can have a significant impact on company performance by capturing and harnessing value from suppliers. M&A highlights this contribution where up to 70% of the value from M&A can come from procurement activities. The CPO’s challenge is securing support for change programs. Programs that drive both ‘cost down’ and ‘cost out’ of the supply chain while simultaneously delivering additional ‘value.’

The need to switch from ‘cost’ to ‘value, is increasingly recognized by procurement leaders, who bind procurement firmly with their corporate strategy and develop closer and closer links as competition increases. They retain control of all processes essential to meeting their corporate strategy and outsource less strategic activities to their chosen partners.

CPO’s must identify market changes and how their processes must adapt to meet these changes. When markets are in turmoil, there is both a threat and opportunity. It is precisely the time to identify the core processes needed to support company strategies and determine which to retain and those outsourced to suppliers.

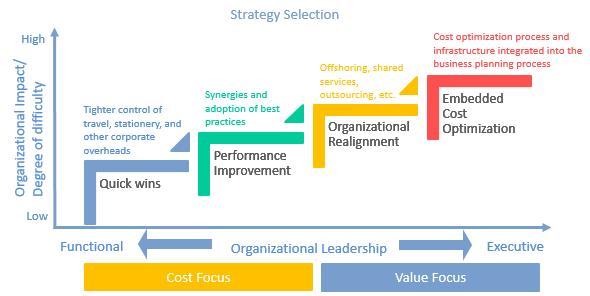

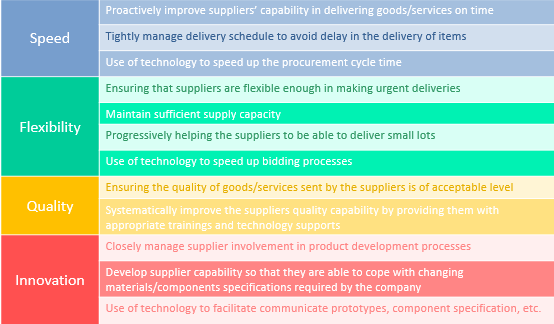

6.2 The Drive for Procurement Excellence

Strategic cost management capability is not an accident. It is not a knee-jerk response to a downturn. Procurement Excellence occurs as a result of proper business processes and applied management capability whatever the economic cycle. Embedded in the organization through a formal governance and control structure that integrates cost optimization into the very culture of the organization. Establishing Supply Management as a Core Competency in the business value chain provides the systematic approach most likely to produce sustainable cost leadership. See Fig 3.

The Brave CPO Optimizing Cost for Value Generation Fig 3: CPP Procurement as a Core Business Process

For Supply Management the strategic goals must be:

- Building Capability in Supply Management (Fig 4)

- Become a Source of Cost Leadership

- Become a Source for Product and Service Differentiation

Such goals require Supply Management to understand the nature and significance of costs for business performance, by considering them in the context of the benefits they produce. The critical question for procurement in this context becomes not ‘how much does it cost?’, but ‘what are the benefits it will produce?’ And ‘how can the business best organize” to manage cost to gain a competitive advantage?’.

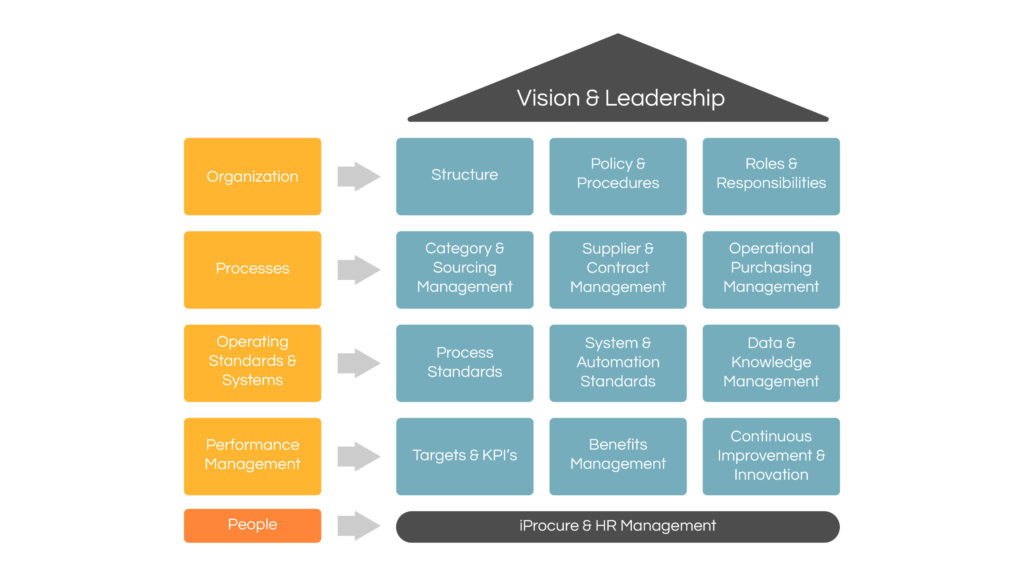

6.1 Building Capability in Supply Management

Developing Supply Management as a Core Competency in the business value chain requires investment in five key performance drivers. See Fig 4. Optimizing the organizational design, recruiting the necessary leaders, embedding the required processes and mobilizing teams remains a formidable challenge.

The Brave CPO Optimizing Cost for Value Generation Fig 4 – CPP Procurement Excellence House: Drivers of Procurement Performance

Strategy & Governance

Due to the importance of external suppliers for most companies, procurement and governance management is of utmost relevance for achieving competitive advantage. The governance structure is a crucial test of best in class. Governance facilitates the integration of the supply management strategy with the corporate strategy, which in turn guides and enables the actions of procurement.

At the executive level effective governance requires:

- Establishing formal processes

- Defining how to form teams

- Defining roles and responsibilities

- Providing senior sponsorship and champions

- Providing the necessary tools, and enablers with appropriate training and development

- Ensuring a supportive environment throughout the organization

- Approving team objectives and authority

People & Organization:

Without access to people with the necessary skill sets no amount of strategizing, investment in technology, etc. is likely to deliver the desired results. CPO’s everywhere are increasingly recognizing this and developing talent management strategies to gain flexible access to talent to produce value whatever phase of the business cycle.

The demands on practitioners continue to increase as procurement’s potential and status continues to gain ground. Increasingly, they not only need to be skilled in the tools of world-class supply management but also a skillful stakeholder and change manager and financial expert.

Crucially they must have the ability to think strategically to see the “bigger picture.” Only by understanding the broader goals and objectives of the organization can they successfully influence strategy and capture strategic value.

Process:

Category management, strategic sourcing and supplier relationship management (SRM) are still at the core of effective supply management. Category management is critical to delivering value from procurement by linking business strategy with supply markets. Strategic sourcing provides a robust methodology to engage supply markets in pursuit of business goals. While SRM is about ensuring suppliers, deliver what was intended it is also crucial for extracting further value beyond the sourcing process.

The key is in making them a business-wide process to provide an agreed framework for managing total expenditure in a defined and well-governed manner. The aim is to develop a “company-wide methodology” where all who have significant contact with suppliers must apply a “minimum competency level.” Thereby ensuring the application of a standardized and robust approach, both in creating sourcing strategies for the company’s spend categories and in executing them with suppliers.

Technology:

Applying technology is an essential aspect of developing procurement capability. Self-service e-purchasing systems automate and speed up purchasing transactions, improve service, and can reduce transaction cost by up to 30%. Technology facilitates better adherence to process, clearer specifications, better structure and increases compliance. Aberdeen found that best in class companies place, on average, 26% more spend under management than all other enterprises, and have, on average, 25% less maverick spend than all other firms.

Spend visibility tools are vital to feed sourcing activities and as the maturity of the procurement organization increases, so conducting e-auctions becomes more comfortable encouraging their use for more complexity procurement. Benefits tracking tools help realize savings from your sourcing activities in the profit and loss figures.

7. Becoming a Source for Cost Leadership:

Improvement of profitability, margin, and earnings per share are at the top of the CEO’s agenda. Managing cost, cash and also capital, has never been more critical. CPO’s must drive home the message how company revenue, the ‘cost of sales’, operating expenses, working capital, and fixed assets can all be directly influenced by procurement.

7.1 Develop skills in critical competencies

The challenge for the CPO is to identify the initiatives and priorities those that add the most value, assess their team’s capability to execute these initiatives and develop appropriate metrics to measure effectiveness. In this way, it is possible to identify the cost optimization competencies that are most relevant to your organization and need strengthening.

Harnessing your crucial supplier resources, capabilities, assets, capital and intellectual property is a significant source of competitive advantage. Likewise, tactical procurement improvement programs, to drive aggressive cost savings, are an equally compelling and necessary competency to drive cost leadership. The CPO must set challenging but realistic targets and select the most appropriate strategy while understanding relevance and contribution to company performance.

7.2 Selecting Challenging Cost Reduction Targets

Cost management ambitions are becoming increasingly aggressive, with many organizations targeting from 3% and as high as 12% annual cost reduction after inflation. When setting cost reduction targets, taking a broader perspective helps by considering them from four different viewpoints:

Internal View:

An internal evaluation of possible cost savings can be developed by analyzing each business unit and function to identify potential savings opportunities across the company.

Competitor View:

When bench marking against competitors, cost savings targets can be set to raise competitiveness against them.

Best in Class View:

When bench marking critical activities against best in class organizations, cost savings targets can be set to overtake competitiveness against direct competitors. Leaders typically outperform laggards, by securing 150% greater ROI on their cost of procurement (Source Hackett), significantly exceeding the cost to extract value from their supplier base.

Investor View:

Most firms attribute positive share price impact to their cost reduction efforts. By setting cost targets in conjunction with financial analyst companies, can determine the level of cost reduction that will be required to support the firm’s share price, assuming no growth in revenues.

Each view provides a different perspective on the selected targets. By reviewing cost reduction from all four aspects, CPO’s can set a cost reduction target that is both achievable and acceptable to both internal stakeholders and investors alike.

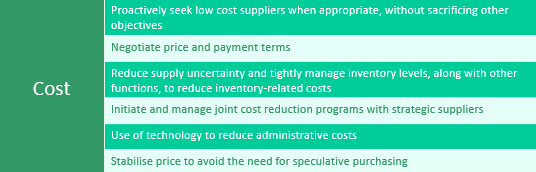

7.3 Advanced Strategies

Procurement leaders go beyond traditional approaches by employing advanced cost management techniques to manage their supply markets more efficiently and effectively than competitors:

Outsourcing Strategy:

Leaders develop a formal business strategy for outsourcing to evaluate ‘make or buy’ decisions during the business planning process to review which goods, services, functions, and operations to outsource.

Collaboration:

Developing cost reduction initiatives with suppliers, and sharing benefits and risks with them, utilizing “should cost” techniques, locking in innovation, technologies and supplier capabilities.

Tiered sourcing:

Combining supplier volumes with their own to enable suppliers to benefit from improved terms

Cost Out:

Revising specifications, processes and reducing complexity to avoid costs.

8. The ‘Brave CPO’ & Value Generation:

8.1 Becoming a Source for Product and Service Differentiation:

The battle for the customer has never been more fierce, and rapid innovation has become an essential component of corporate growth. Leaders invest in superior supplier networks and successfully harness their resources, assets, capabilities, competencies, capital and intellectual property as a source of innovation for competitive advantage.

8.2 Supplier Collaboration

Procurement leaders regard supplier collaboration as a critical source of innovation. During sourcing programs they; review supplier’s commitment and potential for innovative value creation, as part of their supplier evaluation criteria and negotiate clear incentives for suppliers to innovate and measure their contributions.

World-class organizations also include procurement and critical suppliers early in the product or service development process. Accessing innovation in supply markets is neither new nor revolutionary, but making it an essential competency, embedded as a process is vital.

8.3 Capturing Innovation for Growth

The concept of ‘procurement for innovation’ as a value-add tool, is gaining momentum with procurement leaders who regard innovation as a powerful differentiator. Most have got spend management strategies and have integrated deep into the business to drive process improvement. Some also recognize that suppliers are a vital factor in the end product or customer interface.

The real innovators, however, work proactively with their suppliers to generate value-added services that will support achievement of corporate goals. In these organizations, the procurement function closely aligns with sales and marketing and R&D. They use their knowledge of supply markets and close relationships with suppliers to search for new growth opportunities. Developing revenue-generating services to capture market share, retain existing customers and also fuel future demand to create new markets. They are Procurement Entrepreneurs. These companies:

- Align initiatives with corporate plans

- Translate innovation strategy into procurement strategy

- Redefine supplier relationships

- Co-inventing new products and services

- Searching for solutions outside the current supplier base

Having the right suppliers involved early in the innovation cycle can make a huge difference. Furthermore, finding a value proposition that aligns supplier’s interest to your business to become a ‘customer of choice,’ will become increasingly critical as markets become even more dynamic and volatile. For many organizations, however, the performance gap is still considerable.

9. The Brave CPO Optimizing Cost for Value Generation

Are you ready?

With the Brave CPO optimizing cost for value generation, most businesses do not need convincing that cost management is a wise strategic move. However, many still need support in determining both the “what” and the “how” of strategic cost optimization. Without a well-managed program, that can respond to competitive conditions and can accurately capture and report improvements, businesses may find themselves at a competitive disadvantage compared to their competitors.

The stakes are high. Those organizations with high functional maturity, and people with high levels of procurement skills to satisfy the demands of increasingly sophisticated customers, stock markets, and regulatory bodies, are best placed. Regardless of the highs and lows of economic cycles.

Sustaining value creation requires moving beyond cost cutting and into more challenging territory. Considering how to organize tangible and intangible resources and how to align these to serve customers and generate returns for investors. These are important questions regardless of an organizations size or phase of the economic cycle.

Ultimately, those companies with advanced procurement capabilities will be best placed to open up the clear blue sky between themselves and the competition.

Nuff said …

Lean more about how we can help you reduce cost

Learn how you can start your journey to Procurement Excellence